Editor’s Note: Each Friday, WRAL TechWire takes a deep dive into the Triangle’s real estate markets. This week, we take a look at how home sellers can prepare to list their home for sale without facing the prospect of dropping their asking price. One tip: prepare the home in advance of listing it for sale to appeal to the most number of potential buyers, including first-time homebuyers.

+++

RALEIGH – Everyone knows that when mortgage rates rise, real estate deals slow. And when homes are more expensive to buy, there are likely fewer potential buyers who would be interested in bidding on homes for sale.

That leads to a plateauing of price appreciation. Or at least that’s the basic economic theory.

Yet a parcel of real estate does have unique characteristics, namely, its location.

Which means that real estate markets don’t always act uniformly across the country, across a state, or even across town.

And not all homes are the same, either. In the Triangle, there are four factors that changed the market from one of rapid home price appreciation to one where price appreciation appears to have returned to seasonal, cyclical norms.

These four factors are changing the real estate market in the Triangle

What’s happening

So even as buyers and sellers are moving away from real estate markets, especially in the typically cooler winter months, home sale values appear to be plateauing, the latest analysis from national real estate brokerage firm Zillow finds.

Which could mean that sellers who are ready to sell their homes are facing a chilly winter market, Skylar Olsen, the chief economist at Zillow, noted in a statement on Thursday.

“Home prices in October remained in suspended animation as more buyers, but especially sellers, took a wait-and-see approach to market conditions,” said Olsen. “Fewer home sales is the hallmark of a housing market lull, but right now potential sellers sensitive to losing their historically low mortgage rates have as much, if not more, of a reason to wait for a robust spring season and hope for mortgage rate relief.”

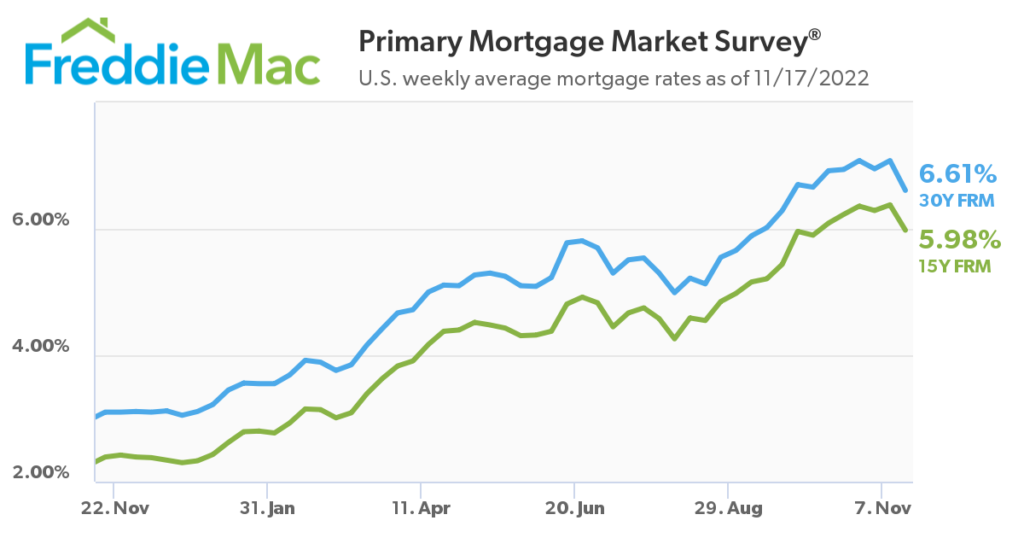

Image and data: Freddie Mac

Still, there was some recent relief in the mortgage market, as the latest data from Freddie Mac showed that rates dropped, on average, by nearly half of one percent, and are now typically 6.6% for a 30-year fixed-rate mortgage.

“With some renewed competition, buyers hoping for aggressive price declines may be disappointed in all but the frothiest pandemic-era markets,” said Olsen.

Median home price falls again in October as houses now selling for less than list price

So what can sellers do?

The Triangle real estate market still favors sellers, slightly, Courtney Brown, a licensed real estate agent with Hunter Rowe in Durham, told WRAL TechWire in October.

“It’s not a buyer’s market, but sellers do have to work,” said Brown. “Sellers shouldn’t expect that they’re going to get everything.”

It’s just not the same real estate market as the region experienced in 2021 or even in the spring and summer of 2022, Brown explained.

So the first thing that sellers ought to do is to moderate their expectations of how a real estate deal might come together.

Now, for example, buyers are much more likely to make an offer to purchase and contract at, or even below, the list price of the home, especially if the home will need repairs, cosmetic updates, or landscaping.

Sellers can expect buyers to move more slowly, as well, which means that a home might not be sold on the first day it is offered on the market, or even the first two weeks.

Number of first-time homebuyers hits record low – but prices in Wake are falling

Do what you can control

Instead of wondering what buyers might do, sellers can consider what they can control about listing and presenting their home for sale, said Tony Fink, a licensed real estate agent with Linda Craft Team REALTORS in Raleigh.

“If you’ve got the ability and the means to prepare your house for the broadest buyer pool, you should,” said Fink. “The percentage of homeowners that want to take on a renovation project, have the cash to do a renovation project, and more importantly, have the time and interest in doing a renovation project, the more turnkey you can make a property, the better it will perform on the open market.”

Homebuyers: Want a great deal on a new home? Here’s what to ask for

Expand the buyer pool

And, added Fink, consider who is most likely to be interested in your home right now: millennial buyers, whether buying their first home or looking to make an upgrade to a home with larger square footage or more bedrooms.

“The buyer pool, and the biggest buyer pool, is going to be the millennial buyer pool,” advised Fink. “When you’re selling your house, you should take a look at it and broaden your appeal for millennial buyers.”

That includes considering making some cosmetic updates in preparing your home, noted Fink, such as repainting the home with more modern, popular colors, changing out old light fixtures for more energy efficient, sleeker ones, and focusing on the curb appeal of the home.

Some home sellers may also consider offering an incentive to potential buyers who could be concerned about affordability at today’s mortgage interest rates, by offering to assist would-be buyers pay additional fees at closing to access a mortgage lender’s rate buydown program, which could make the home more affordable to buy at the seller’s asking price.

+++

WRAL TechWire reporter Jason Parker, the author of the report and a licensed real estate agent in North Carolina, works with journalists from WRAL.com to track and present market data and report on how people are experiencing the region’s changing real estate markets. These special reports will use the category tag “Triangle Real Estate” or “Triangle Real Estate Market.